Week 1: How I Research Startup Ideas

Part of the “Building My Second Startup from Scratch” series

In my last post, I talked about coming up with startup ideas. Today, I’m diving into how I actually research and validate those ideas before talking to customers.

I’m currently in week 5 of building my new startup (codename: Project25 or P25), but these posts are a bit behind. Today’s piece covers weeks 1-2: the research phase.

Next week, I’ll share how I approach customer development and talking to people.

Setting Up Your Research Infrastructure

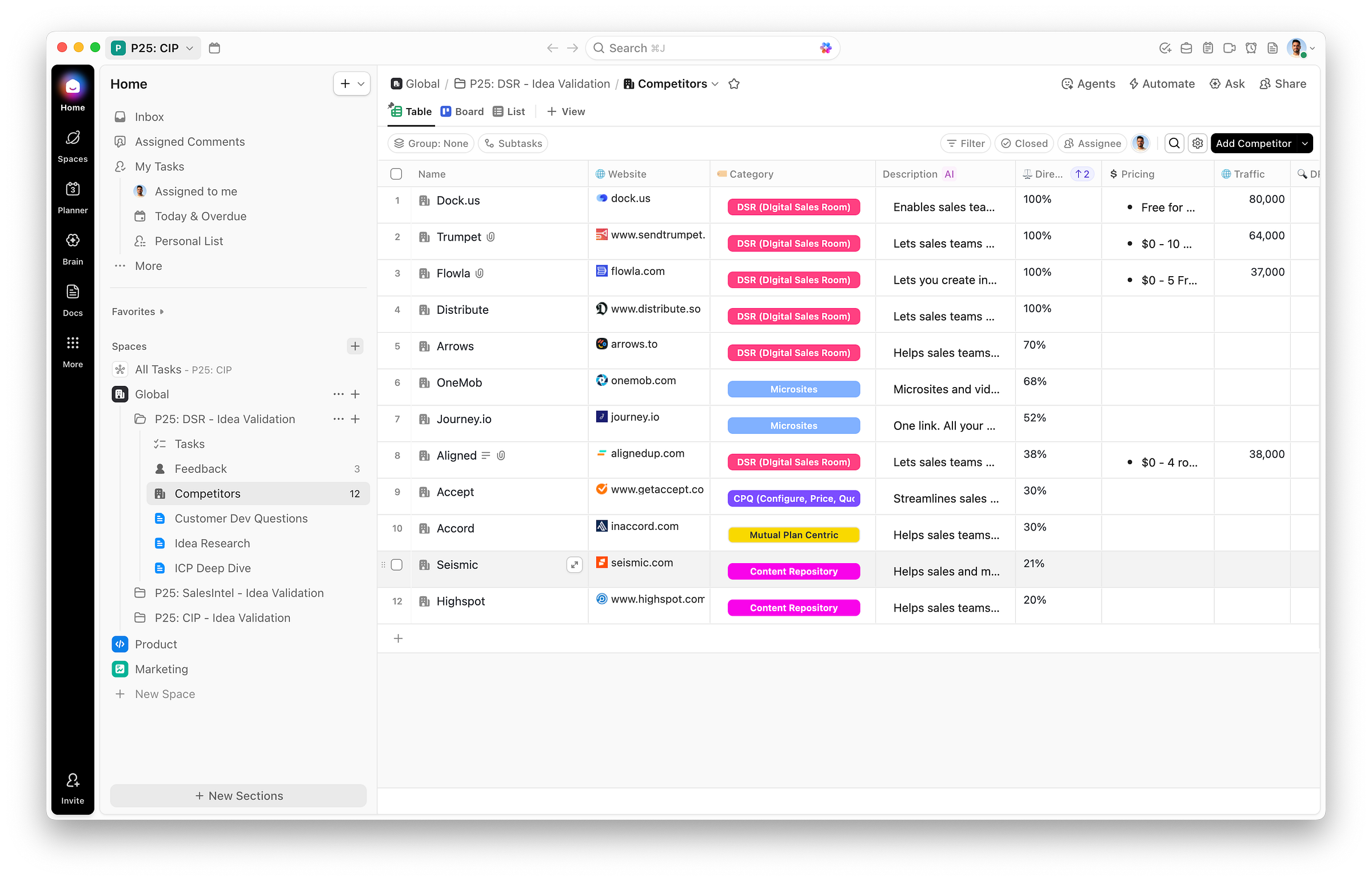

The first thing I do when starting to research an idea is create a project to organize everything. I use ClickUp, but Notion or any similar tool works just as well.

Here’s how I structure it:

Project Organization

I run small validation sprints (anywhere from a few days to two weeks) for each specific idea. For each sprint, I create:

1. Task Management

Specific action items (research tasks, customer calls, feedback collection)

Clear next steps and deadlines

Progress tracking

2. Customer Feedback Table

A CRM-style table tracking every cust. dev. conversation with columns for:

ICP Status: Are they ideal customer profile?

Type: I bucket people into two groups and I aim to reach out to one of them: experts or potential customer.

Position & Company: Their role and organization

Business Type: Company size, industry

Contact Info: LinkedIn, email

Problems Identified: Key pain points they mentioned

Notes & Recordings: Links to call recordings. I use Fathom for recording calls and Granola for taking notes.

This essentially becomes a lightweight CRM for customer development.

3. Competitors’ Table

Pricing model

Description (I use AI to scrape: “Check website and explain what the tool does in 1-2 short lines. Try to highlight something that makes this tool unique”)

Direct vs. indirect competitor status

Marketing data (just to gauge size)

USPs: What makes them unique

Weaknesses: Where they fall short

I also do UX/UI video walkthroughs where I record myself using competitor software for the first time, sharing my raw reactions and notes.

4. Customer Development Questions

I keep a list of questions based on The Mom Test framework (more on this in the next post). I rarely delve deeply into these topics during actual calls. Conversations usually take unexpected directions. But having them helps me know what to listen for and read between the lines.

Pro tip: Ask ChatGPT to “write customer development questions that follow the Mom Test structure” for your specific idea.

5. Research Notes

This is where I conduct in-depth research, brainstorm ideas with ChatGPT, gather landscape insights, and analyze the market.

Why This Structure Works

The beauty of tools like ClickUp and Notion is their AI capabilities. You can query all your collected feedback and research. I don’t use it much since I remember most of my research, but for bigger projects, it’s invaluable.

For each new idea sprint, I just duplicate this project structure and start fresh.

What I Look for Before Researching an Idea

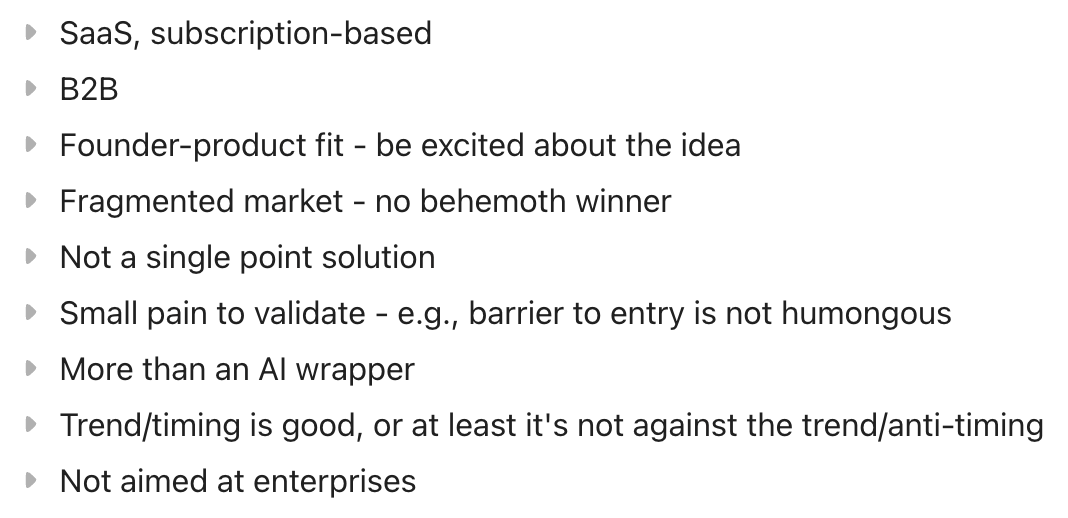

Before I invest time in deep research, I check if an idea meets these 10 criteria:

1. Recurring Subscription Business

Software as a Service (SaaS) only. Recurring revenue is essential.

2. B2B Preferred

B2C unit economics are much more challenging, and I don’t have extensive experience in that area. B2B is where I focus.

3. Product-Founder Fit

This is crucial. Would I be excited to work on this for the next 5+ years, even if it’s unprofitable for the first 6-12 months?

If the answer isn’t a genuine “yes”, if I’m only excited about making money but not the actual problem, I move on.

4. Fragmented Market

Are there behemoth competitors dominating the space?

With my previous startup, Encharge (a marketing automation tool), we failed to meet this mark. We competed against Salesforce, Marketo, and HubSpot. Big mistake.

You don’t want to compete with the Clays, Zapiers, and Figmas of the world. Once you have an established winner, they rarely change.

Now I look for spaces without a clear, dominant winner. Examples:

Cold email tools (outside of Clay’s lead gen orchestration space)

Digital sales rooms (DSRs)

Facebook ads tools, etc.

When a huge player has been in a space for 5-10 years (which is dog years in startup time), they’re a dinosaur. You can carve out a small piece, but you can’t disrupt them. It happens occasionally, but it’s rare.

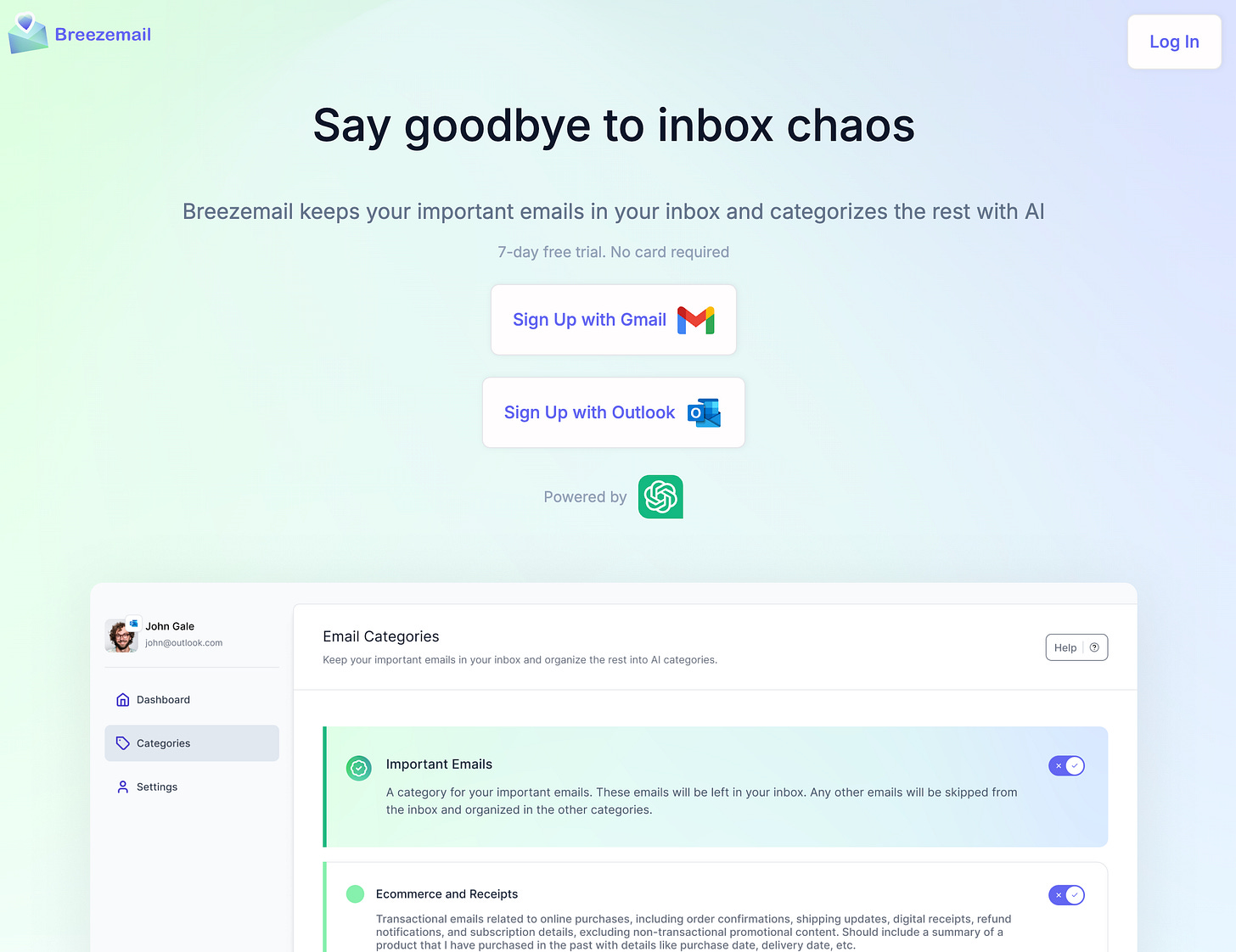

5. Not a Micro Solution

I want to build substantial products. I’ve done the micro-solution thing with Breezemail (a simple email categorization tool we sold for $5,000 on Acquire.com). It wasn’t engaging. I want to work on bigger ideas.

6. Small Pain to Validate

What’s the barrier to entry for validating and building an MVP?

With Chargey, the barrier was extremely high—we were competing with HubSpot’s billions. I now prefer ideas that are easier to validate.

7. More Than an AI Wrapper

With ChatGPT and Claude adding more features constantly, will this be more than a simple AI wrapper? Or will it get commoditized?

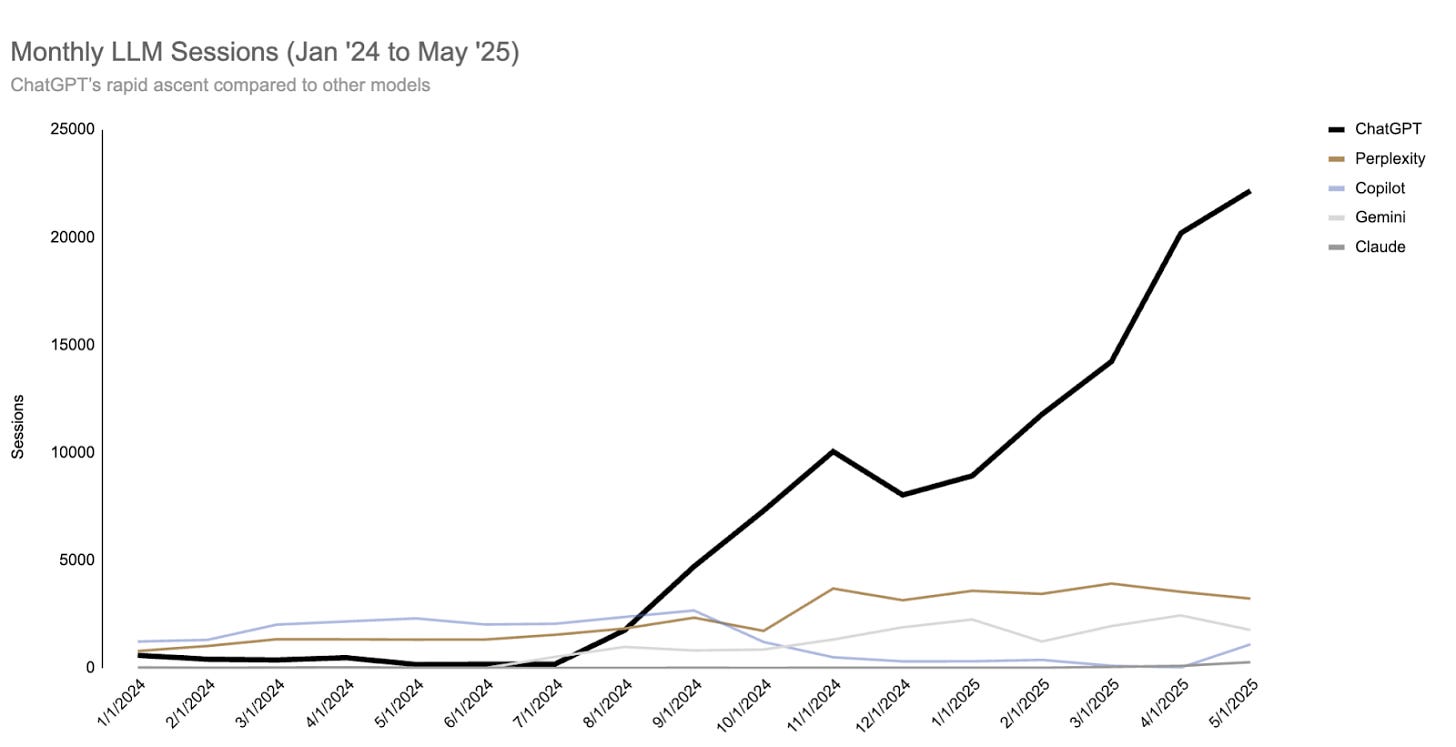

8. Trend and Timing

Is the timing good? At minimum, I need to avoid building against a trend.

Good example: Three days ago, Shopify announced an official partnership with ChatGPT for direct purchases in the chat. That’s riding a wave.

Bad example (an anti-trend): Building traditional SEO tools right now with Google’s AI Overviews disrupting search. That’s an anti-trend.

I don’t need to ride a massive wave, but I can’t build against one. I don’t want to enter a space where people have FOMO and are looking in a different direction.

9. Not Enterprise

I have no enterprise connections. I won’t be the right person to sell to enterprises.

10. Single Point Solution (That Matters)

Not a micro-solution, but a focused solution to a real problem.

Research Frameworks

Once an idea passes my 10-point checklist, I use three frameworks.

Important: Don’t put the cart before the horse. Get some initial validation or interest before diving deep into frameworks.

These frameworks should take 20-30 minutes each, not a week of contemplation.

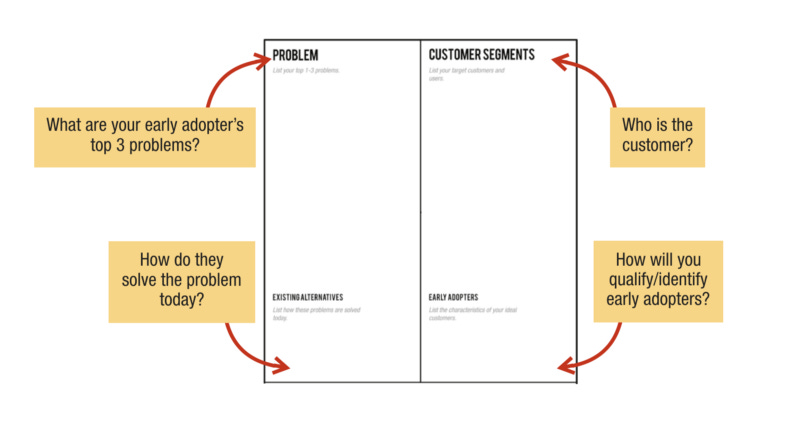

1. The Lean(er) Canvas – Lean Canvas Simplified

Created by Ash Maurya, the Lean Canvas focuses on:

Who is your customer?

How do you identify early adopters?

How do they solve the problem today?

What are the top 3 problems?

It’s focused entirely on the segment, audience, and problem—not marketing channels or business models. Check out Ash Maurya’s videos for more details.

Example from my Digital Sales Room idea:

Customer: Account Executives, SDRs (secondary segment)

Top 3 Problems: [My initial hypothesis, which changed after research]

Existing Alternatives: How they currently solve it

Unique Value Proposition: One-liner on my solution

The 5PM Framework

From Rob Walling at MicroConf, this covers:

Problem: What problem exists?

Purchaser: Who is the ICP?

Pricing model: How will I charge?

Market: What’s the TAM?

Product-founder fit: Am I excited about this?

Pain of validation: How hard is it to validate?

Example questions I answer:

For the problem:

How important is it?

How urgent is it?

Are people actively searching for solutions?

I use Google Trends to check if the keyword is growing. Important tip: Compare your specific keyword to adjacent or broader terms to gauge relative demand.

For my DSR idea, I compared “digital sales rooms” to “sales enablement” and “sales asset management.” Digital sales rooms was tiny in comparison, not necessarily a red flag about market size, but something to keep in mind as it indicates a smaller total addressable market (TAM).

Pro tip: After thinking through the framework yourself, you can ask ChatGPT: “I have this basic idea [explain it]. Fill out the 5PM framework for idea research.” It does a great job.

The STRIKE Framework (My Own)

This is my combination of Lean Canvas and 5PM, plus my own additions:

S - Specific Job to Be Done

What’s the clear JTBD for my customers?

What’s the JTBD for my customers’ customers?

Example for DSR: “As a SaaS sales leader, I want a personalized space that adapts to trial usage so I can shorten sales cycles and smoothly onboard them with internal consensus.”

T - True Problem

Does the product solve a real problem?

Is it widespread across the target market?

Is it expensive or urgent enough?

R - Reachable Audience

Is there a clear audience?

Are their pain points well understood?

Are they reachable and willing to adopt?

I - Investment Required

How much time, money, and effort to get to MVP?

Is there automation potential?

Does it solve a repeatable, annoying task people do daily or weekly?

K - Key Advantages

Do we have unique skills, resources, or moats?

What competitive advantages can we leverage?

E - Evaluation of Market

What’s the competitive landscape?

Are there behemoths or is it fragmented?

Most questions in this framework can’t be answered with certainty at this stage—but they help you form hypotheses.

Deep Research with ChatGPT

I’ve found ChatGPT to be an incredible assistant for getting a landscape overview. I spend tons of time going back and forth with it about ideas.

Setting Up ChatGPT for Research

1. Create a Separate Project for Each Idea

I create a separate ChatGPT project for each validation sprint. This provides ChatGPT with context and saves me from having to rewrite background information every time.

2. Use a Research Brief Template

There are two approaches:

Approach A: Full Freedom

Keep it super brief: “I’m doing deep research on [this idea].”

Let ChatGPT use its own judgment about what information to give you and what approach to take. This often surfaces information you didn’t know you didn’t know.

Approach B: Guided Research

I use this approach from Torsten Walbaum.

Use a detailed template covering:

Strategic Goal: Why are you doing this research? What does success look like?

Product Concept & Scope: Explain your idea, target use case, USP

Target Market: Who’s this for?

Competitive Priorities: Rank what’s most important (technical capabilities, business model, go-to-market, customer adoption, etc.)

Hypothesis & Pain Points: What do you suspect is missing? What pain points have you heard?

Report Preferences: Quick landscape overview, deep dive, or investigative report? What format?

Pro tip: Ask ChatGPT to start with “key insights and recommendations before going into details. Use overview tables or visuals instead of text blocks where appropriate.”

You can use this prompt:

📝 Deep Research Intake: [Your idea]

1. Strategic Goals

Why are you doing this research? (e.g., validate market entry, test hypotheses, attract investors, competitive mapping)

What would success look like from this report?

2. Product Concept & Scope

One-liner vision of your product (plain-language description).

Target use cases (e.g., knowledge retrieval for sales teams, internal documentation search, customer support knowledge base).

Key differentiators you’re considering (e.g., AI-driven summarization, real-time SaaS integrations, security focus).

3. Target Market

Customer segment (SMB, mid-market, enterprise).

Industries of focus (general vs. SaaS-only vs. vertical-specific).

Geographic focus (North America, EU, APAC, global).

4. Competitive Priorities

Rank the following in order of importance for your research:

Technical capabilities (AI/LLM, semantic search, integrations).

Business model & pricing.

Go-to-market strategy (PLG vs. enterprise sales).

Customer base & adoption.

Security/compliance posture.

Other (please specify).

5. Hypotheses & Pain Points

What do you suspect is missing in today’s tools?

What pain points have you heard from potential users or customers?

6. Report Preferences

Depth: (quick landscape, deep dive, or investor-grade).

Format: (competitive matrix, SWOT, emerging trends, gap analysis, TAM/SAM/SOM sizing).

Deliverable style: (executive summary, long-form report, presentation-ready slides).Example from my current sprint (enterprise search and knowledge management for SaaS):

Strategic Goal: “Validate if entering the market with a B2B SaaS-specific enterprise search tool that provides actionable insights would create appetite. Success = tangible quantifiable data indicating market potential, unique positioning angles, and better understanding of competitors.”

I then give it the full product concept, priorities, and my hypothesis.

The Research Process

ChatGPT gives you a proposed research plan

Review and fine-tune the plan (Gemini is even better perfect for planning. You can get the plan there and paste it in ChatGPT)

Once satisfied with the plan, give ChatGPT the green light to do the research.

The output is incredibly detailed and helpful. Here’s the actual conversation link again.

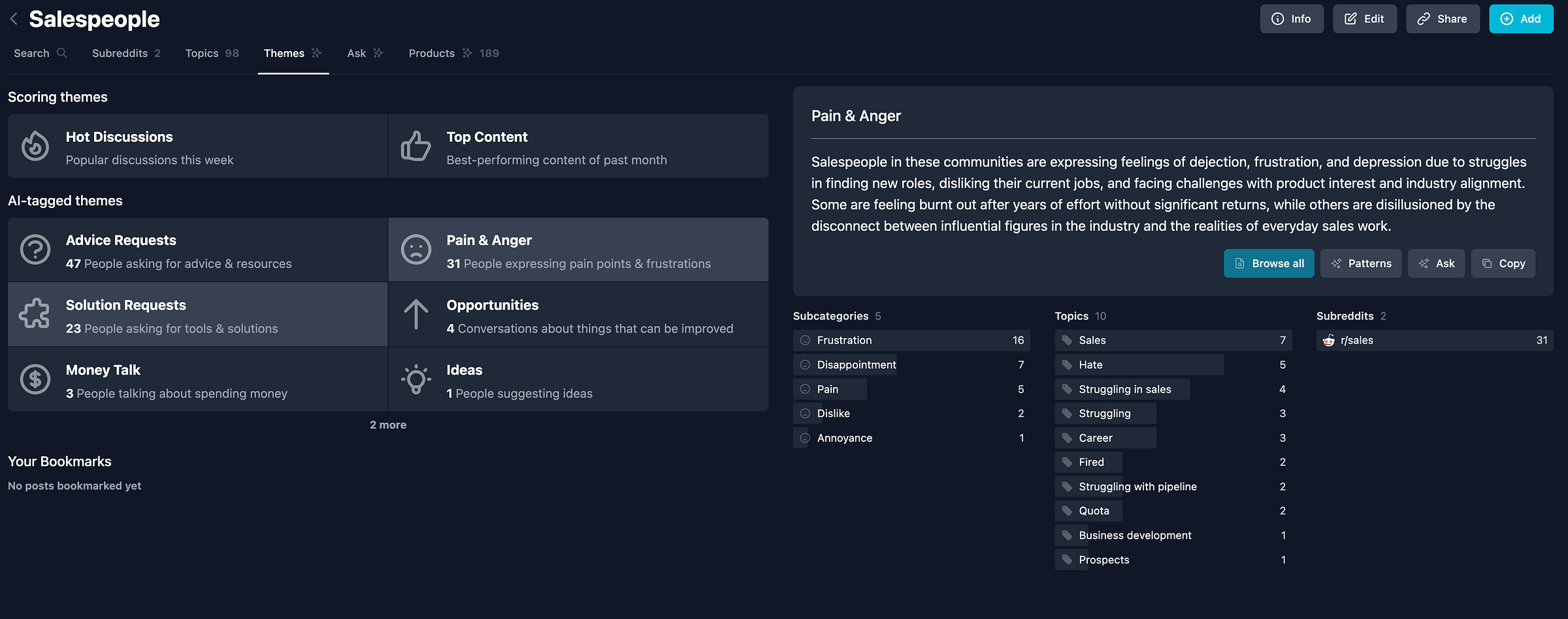

Reddit Problem/Idea Research

There are now dozens of tools for Reddit research:

Gummy Search

Big Ideas Database, etc.

I tried them and had mixed results.

What These Tools Do Offer

Gummy Search example

Choose your audience (e.g., “salespeople”)

Select relevant subreddits (e.g., r/sales with 500K members)

Browse categories:

Hot discussions

Top content

Advice requests

Pain and anger

Solution requests

Opportunities

Themes section shows patterns like: “Users are expressing frustration due to struggles finding new roles, disliking current jobs, and facing challenges with product-market fit.”

You can click through to see actual posts and comments.

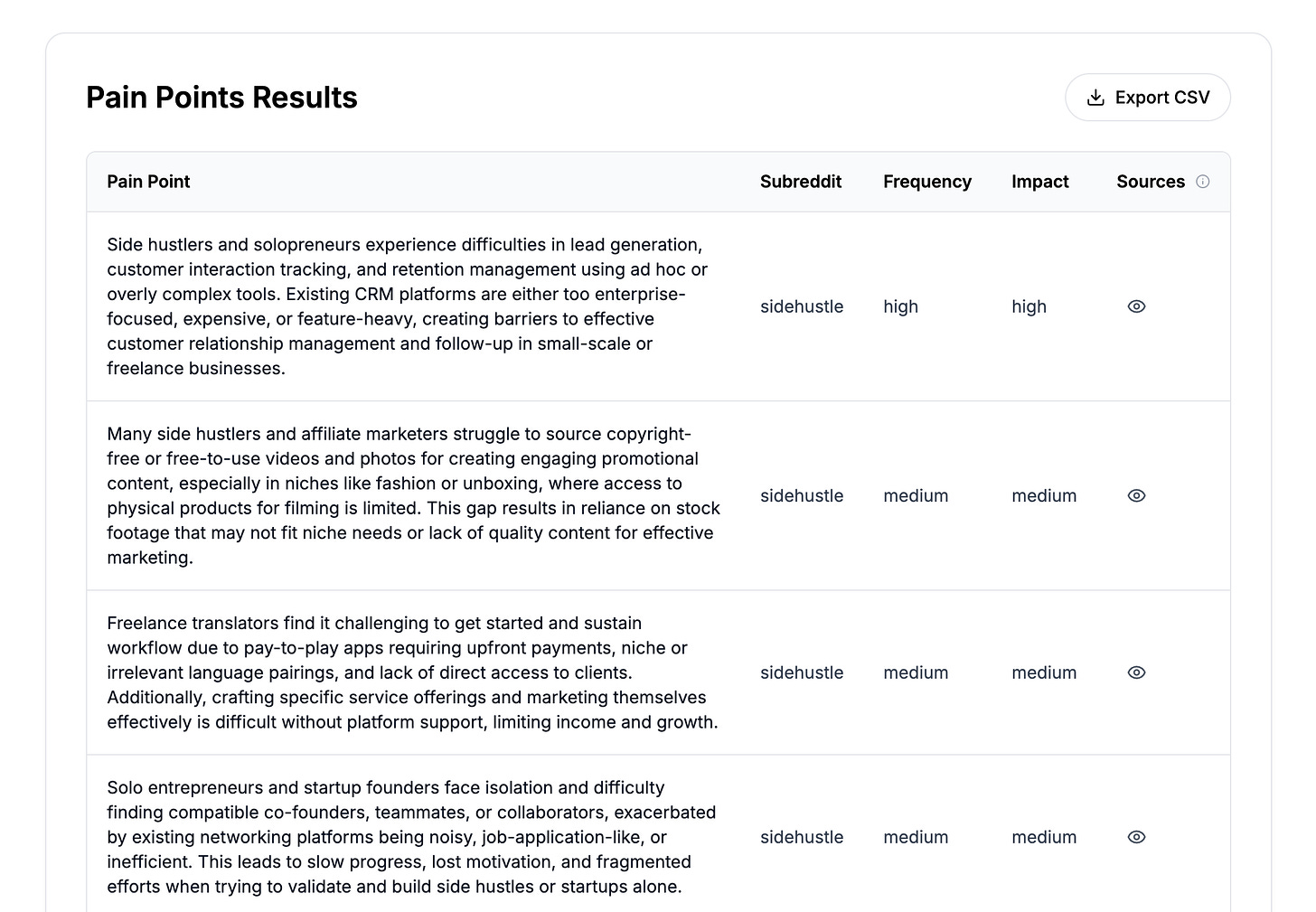

BigIdeasDB is more of a list of ideas and pain points:

Here’s another way to search Reddit for problems. A Google search query, credit to StarterStory:

“{Market to explore}” (

site:reddit.com

inurl:comments|inurl:thread

| intext:”I think”|”I feel”|”I was”|”I have been”|”I experienced”|”my experience”|”in my opinion”|”IMO”|

“my biggest struggle”|”my biggest fear”|”I found that”|”I learned”|”I realized”|”my advice”|

“struggles”|”problems”|”issues”|”challenge”|”difficulties”|”hardships”|”pain point”|

“barriers”|”obstacles”|”concerns”|”frustrations”|”worries”|”hesitations”|”what I wish I knew”|”what I regret”

)

The Problems I Found

1. Lack of Statistical Significance

Tools say “here’s a specific problem people have,” but when you dig in, it’s just 1-2 people mentioning it. There’s no data on how widespread the problem actually is.

2. Vague Problems

People think they have a problem, but they haven’t actually looked for a solution. The problems are often theoretical.

3. AI Over-Optimization

These tools’ goal is to find problems, so they find problems where there might be none. You need to be really careful.

My Verdict

I went through 100-200 ideas on Big Ideas Database and various Gummy Search threads. I found some interesting insights, but most problems were too vague and didn’t resonate with me.

Alternative approach: This old-ish guide on manual Reddit research (before the Reddit research tools existed) might be better. It teaches you to:

Identify relevant subreddits

Look for problems, motivations, and actions

Find what recommendations people ask for

Spot recurring complaints

Understand what would make achieving their goals easier

By all means, try these tools, they’re cheap. But manage your expectations.

G2 Review Analysis

Once you have the landscape overview from ChatGPT and have filled in your frameworks, it’s time for deeper competitor research.

The most productive way I’ve found: scrape and analyze competitor reviews.

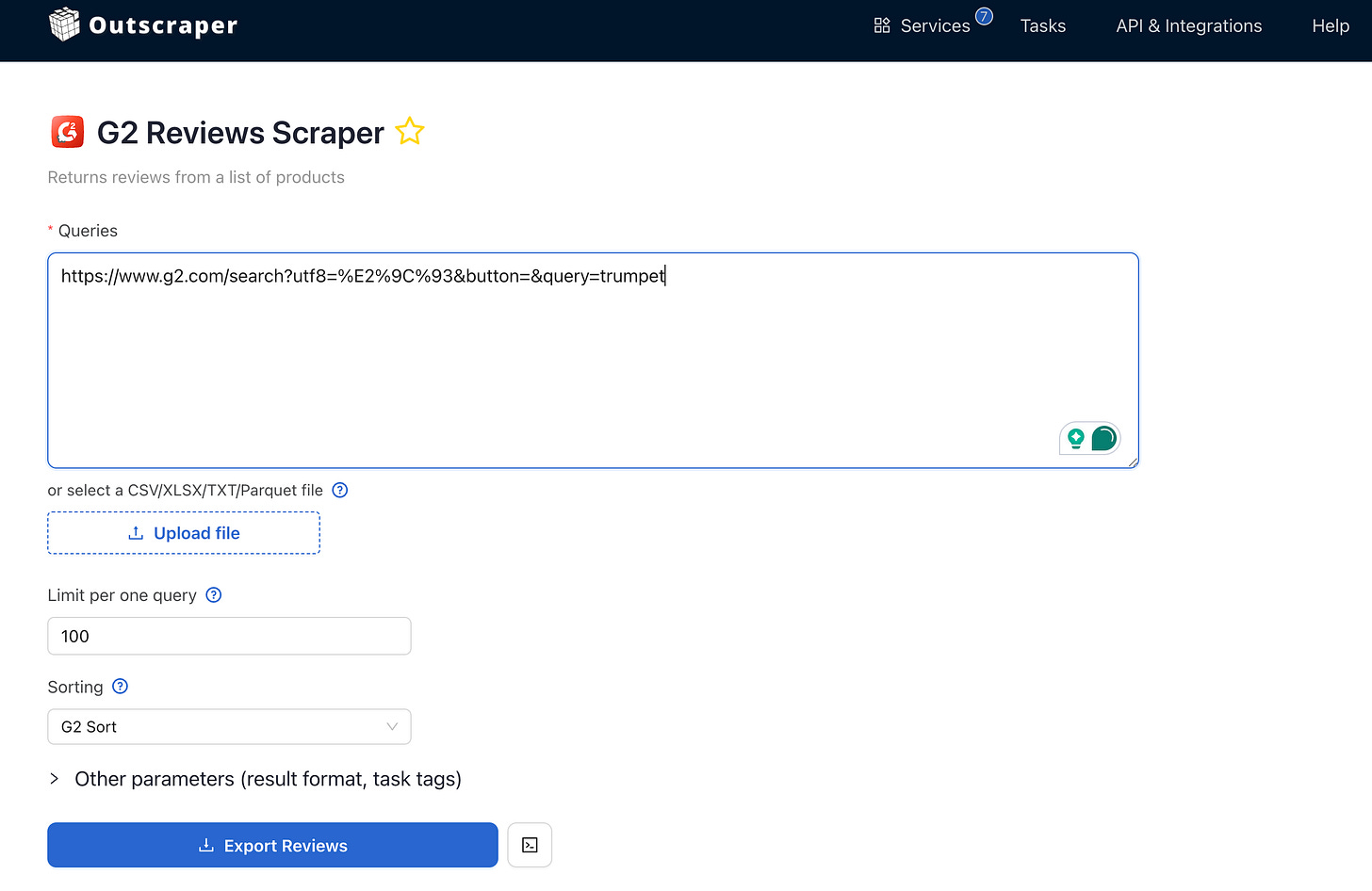

The Process

1. Scrape Reviews

I use Outscraper (about $5 for 1,000 reviews). It has an easy-to-use built-in G2 review scraper that handles CAPTCHAs, proxies, etc.:

Paste in the product link

Download a CSV with all reviews, ratings, user info, etc.

2. Analyze with ChatGPT

Upload the CSV to ChatGPT and use this prompt structure to do a grounded analysis and find patterns:

**Objective**: Grounded analysis to find patterns

**Context**: This is a [category] product

**Key Aspects to Extract**:

- Common pros and cons

- Themes and patterns

- Sentiment analysis

- Comparison points

- Suggestions

- Structure: bullet points, summary tables

- Tone of audience

**Optional**:

- Categorize feedback by company size

- Break down by industry

**CRITICAL INSTRUCTIONS**:

- Be as specific as possible

- Be objective, not overly positive

- Show specific examples to illustrate points

- Explain your reasoning

- Don’t latch onto one quote as a trend—show statistical significance

Ensure that you include the critical instructions: without them, ChatGPT will be overly optimistic. It will see one person say “I had a UI issue with Trumpet” and conclude “People have problems with UI, make yours better!”

That’s false. You need objective, grounded analysis that shows how many people mentioned each issue and how significant it really is.

Putting It All Together

This is a lot of information, I know. Here’s the order I recommend:

✅ Quick validation check: Does the idea pass my 10 criteria?

✅ Initial frameworks: Spend 20-30 minutes on Lean Canvas, 5PM, or STRIKE

✅ Deep ChatGPT research: Get landscape overview and competitive analysis

✅ Optional Reddit research: If your audience is active there

✅ G2 review analysis: Deep dive into competitor weaknesses

Remember: Don’t do deep research before you have at least some initial validation or pull. These frameworks help you think through ideas quickly, they’re not meant to keep you in research mode for weeks.

What’s Next

I didn’t have space here to be super specific about individual ideas I’m validating, but if you want me to walk through a specific example in detail, let me know in the comments or DM me.

Next week: Customer development. How I approach talking to people, what mistakes I’ve made, and what I’m doing differently this time around to validate ideas through conversations.

Thanks for reading. See you in the next one.

If you’re finding this series helpful, consider subscribing. I’m documenting everything as I build this startup in real-time.